Is Dropshipping Legal in Australia?

Dropshipping is one of the most popular ways to make money in 2023, with nearly 23 per cent of all online sales fulfilled through dropshipping and 33 per cent of online stores using the dropshipping business model in some capacity. Dropshipping is an excellent solution for new and existing businesses, thanks to its low barrier of entry. It requires little starting capital, no qualifications and no inventory space. Unfortunately, these same benefits also attract low-quality suppliers and retailers looking to get rich quickly. We at Dropshipzone have put together a handy guide for separating sketchy dropshipping businesses from legitimate sources, so you and your customers can feel confident shopping online.

What is Dropshipping?

Dropshipping is a fulfilment method wherein retailers connect to third-party wholesale suppliers that provide shipping services. When a customer places their orders from a dropshipping retailer, the retailer orders stock from the supplier, who ships it directly to the customer. Dropshipping benefits retailers because they don’t have to hold or purchase inventory, meaning fewer overhead costs. Suppliers outsource marketing to retailers and have more opportunities to sell their products to new target audiences. Consumers benefit from fewer stockouts and greater product availability, especially within niche markets. It’s a win-win for all parties involved in the supply chain.

Dropshipping is not a new business model - it has been around since before the internet. In the 1950s, mail-order catalogues were the top method for selling to consumers outside brick-and-mortar stores. As department stores struggled to keep up with demand, they created fulfilment warehouses to store large quantities of goods and speed up the delivery process. This is similar to how Fulfilment By Amazon (Amazon FBA) functions today. In the 1990s, these mail-order catalogues moved into online shopping and made big promises to investors about their expected profit margins. Unfortunately, many of these early online stores failed due to negative early views of the internet, distrust in online sellers, and rising shipping costs from US dropshippers. In the 2000s today’s ecommerce giants, Amazon and eBay, emerged, making online selling (and by extension, dropshipping) accessible to both big and small businesses. Finally, in 2010, Alibaba released Aliexpress, which simplified the process of working with Chinese suppliers, making it easier and cheaper to ship from China instead of the US. Around the same time, ecommerce store building sites such as Shopify appeared, making it easy for businesses to create independent online storefronts. Now, dropshipping is one of the most accessible and popular online business models in the world.

There is nothing inherently illegal or unethical about dropshipping. It is a widely used business model, with several worldwide brands using dropshipping to prevent understocking, provide a wider variety of products to consumers, or offload seasonal stock. Where suppliers and retailers can struggle is sourcing legitimate products that are legal to sell in Australia and are ethically produced.

Is Dropshipping Legal?

Yes, dropshipping is a legal business model in Australia and other countries. Anyone can legally dropship within Australia as long as they comply with Australian Consumer Law and other relevant legislation that applies to any retail businesses operating in Australia.

Why Do People Think Dropshipping Is A Scam?

Popular industries and product categories can attract business owners from all walks of life, including scammers. This influx of substandard suppliers, products and retailers has given some Australian consumers a poor impression of dropshipping.

Some common concerns about the dropshipping model include:

Counterfeit or unlicensed products

Sometimes suppliers will capitalise on the popularity of luxury goods by offering counterfeit or unlicensed products. Counterfeit products are designed to look like (and may feature the trademark of) a legitimate brand but are made by a different, unrelated party without the brand’s authorisation. Unlicensed products may feature trademarked images in a manner that is likely to cause confusion, deception or mistake about the source. Manufacturers usually target luxury, collectable or popular brands such as Gucci, Nike and Apple to produce counterfeit products deliberately. A business may not have intended to use trademarked/copyrighted content, but its products can still fall under trademark/copyright infringement. The Walt Disney Company is well known for coming after businesses of any size using unlicensed Disney assets, even if the art is original work. Small business owners can struggle to enforce copyright against large overseas manufacturers, especially where their art is available on social media.

Quality control

Because dropshipping retailers do not keep inventory, they may rely on suppliers for quality control. This can lead to supply chain issues such as:

-

Products arriving not as described.

-

Products not being fit for purpose.

-

Faulty or broken products.

-

Products arriving in unsafe conditions.

-

Lengthy shipping times (especially when using overseas suppliers).

Regardless of which party is at fault, retailers are responsible for solving customer complaints. Retailers will also bear the brunt of any negative reviews. The solution to this problem is to choose reliable suppliers with a good reputation, no hidden fees for their service, dependable customer service agents and clear policies regarding returns and refunds. Before selling products, retailers may also want to visit the supplier or manufacturer’s warehouse to see the products first-hand or order sample products to ensure product quality, packaging and shipping times are as described. Alternatively, businesses can hire a third-party quality assurance agent. After choosing a supplier, building a healthy relationship with them will ensure clear communication and effective problem-solving.

Sketchy sales

Fraudulent suppliers and retailers can disappear as quickly as they appear. These businesses will design easy-to-launch sites using popular marketplaces before aggressively marketing on social media, particularly Facebook and Instagram. They will use stock or third-party images and text to sell their products. Such suppliers may send products inferior to the purchased product or take the money and disappear, leaving retailers and customers with nothing. They may also use the data provided at checkout to participate in phishing scams and other schemes.

How to spot fake dropshipping suppliers:

-

They sell to the general public at wholesale cost.

-

They refuse to provide samples.

-

They refuse to sign a contract.

-

They ask for recurring membership fees.

-

They make claims of fast and high-profit margins.

-

They are hard to contact.

-

They don’t have their own website.

How to spot fake dropshipping retailers:

-

They feature high-ticket items at low prices.

-

They sell products prohibited in your country.

-

They use low-quality photos.

-

They ask you to pay off the site you purchased from.

-

They don’t have a clear return policy.

-

They are hard to contact.

-

They don’t have their own website.

You can also proactively avoid scammers by visiting their website, checking their reviews online, asking about the company in forums, reverse image searching their product pictures, googling their product descriptions, checking the registration information for their online store, or checking reliable dropshipping directories.

Dropshipping courses or seminars

Whether they’re posing as financial advisors, motivational speakers or insider experts, all fake dropshipping ‘gurus’ promise the same thing - quick gains with little effort. These courses can cost anywhere between hundreds and thousands of dollars. They use aggressive marketing tactics to convince potential customers that their courses are the only way to financial freedom through passive income. Many of these gurus use repackaged free resources to make their content. They may even use fake sales and statistics to make their dropshipping company seem legitimate. These courses create false expectations of dropshipping by showing off luxurious lifestyles. They don’t cover the most important aspects of ecommerce, such as market research, store optimisation, SEO and average profit margins, each necessary for the success of a dropshipping business.

There are plenty of resources available that new and aspiring entrepreneurs can use to gain and enhance their knowledge about dropshipping business. Social media sites such as Reddit and YouTube have free resources made for and by fellow dropshippers. Sites like Shopify and Dropshipzone have blogs dedicated to all aspects of ecommerce. Ubersuggest and Google Trends are ideal for SEO and market research. Coursera provides free and paid courses for anything from entrepreneurship to content marketing. Free resources should be the first point of contact before considering expensive courses.

Ethical selling

Many consumers worry that dropshipping is neither environmentally nor ethically friendly. In reality, dropshipping suffers from the same issues as any other retail business relating to sustainability. Some biggest sustainability complaints that companies face today are travel miles, packaging, sustainably sourced materials, and slave labour. These complaints are often levelled at dropshipping due to many overseas suppliers involved. However, there are plenty of ways dropshipping can be sustainable.

-

In dropshipping, products are shipped directly from the supplier’s warehouse to the end customer instead of going from supplier to retailer and retailer to the end consumer. One shipment means fewer resources are used.

-

While, historically, the US and China had the best concentration of dropshipping suppliers, these companies now exist all over the world, including Australia. This means customers can support local businesses from purchasing to shipping.

-

The increase in sustainability awareness has caused an uptick in eco-friendly products. Eco-friendly packaging is also soaring in popularity, so partnering with suppliers that offer sustainable products and packaging is one of the many ways to make dropshipping sustainable.

-

Many businesses, such as Dropshipzone, enforce strict policies on ethical sourcing. This means that products supplied to the platform are made in places where employment is freely chosen, no child labour takes place, wages and benefits are paid, and there are safe and clean working conditions. Products are also made with adherence to all local environmental laws. At the same time, businesses are expected to maintain policies and procedures around the safe disposal of waste, efficient use of energy and water, and risk reduction around pollution, deforestation, loss of biodiversity and greenhouse gas emissions.

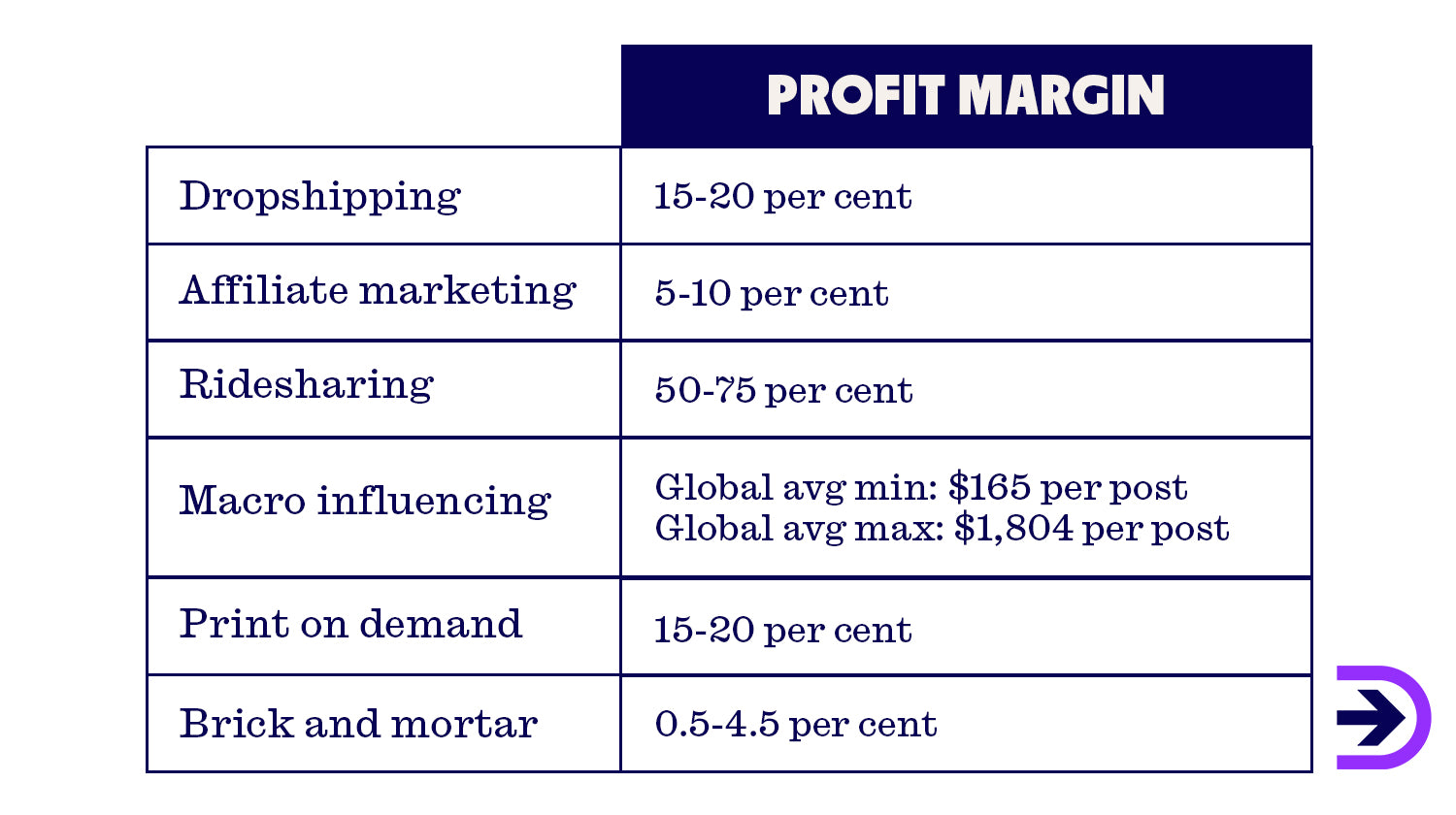

Low-profit margins

Dropshipping has an average profit margin of 15-20 per cent, depending on the product niche and the average cost of goods. While this is lower than other business models, that doesn’t mean dropshipping is not a good business idea. Successful dropshippers working between 10-15 hours a week have a predicted income of between $1,000 and $2,000 - perfect for a side hustle. Dropshippers seeking at least 75k a year need to work at least 40 hours per week for 12 months before seeing results. Online stores focused on optimisation, marketing, and conversions will see even more success with patience, effort and time. You can read more on our blog “How Many Hours Do Dropshippers Work?”

Legal Considerations for Dropshipping

Starting an online dropshipping business should be worry-free. Here is a list of legal considerations to be aware of before starting an ecommerce business.

Be Sure to Register Your Business

Australian Business Number (ABN)

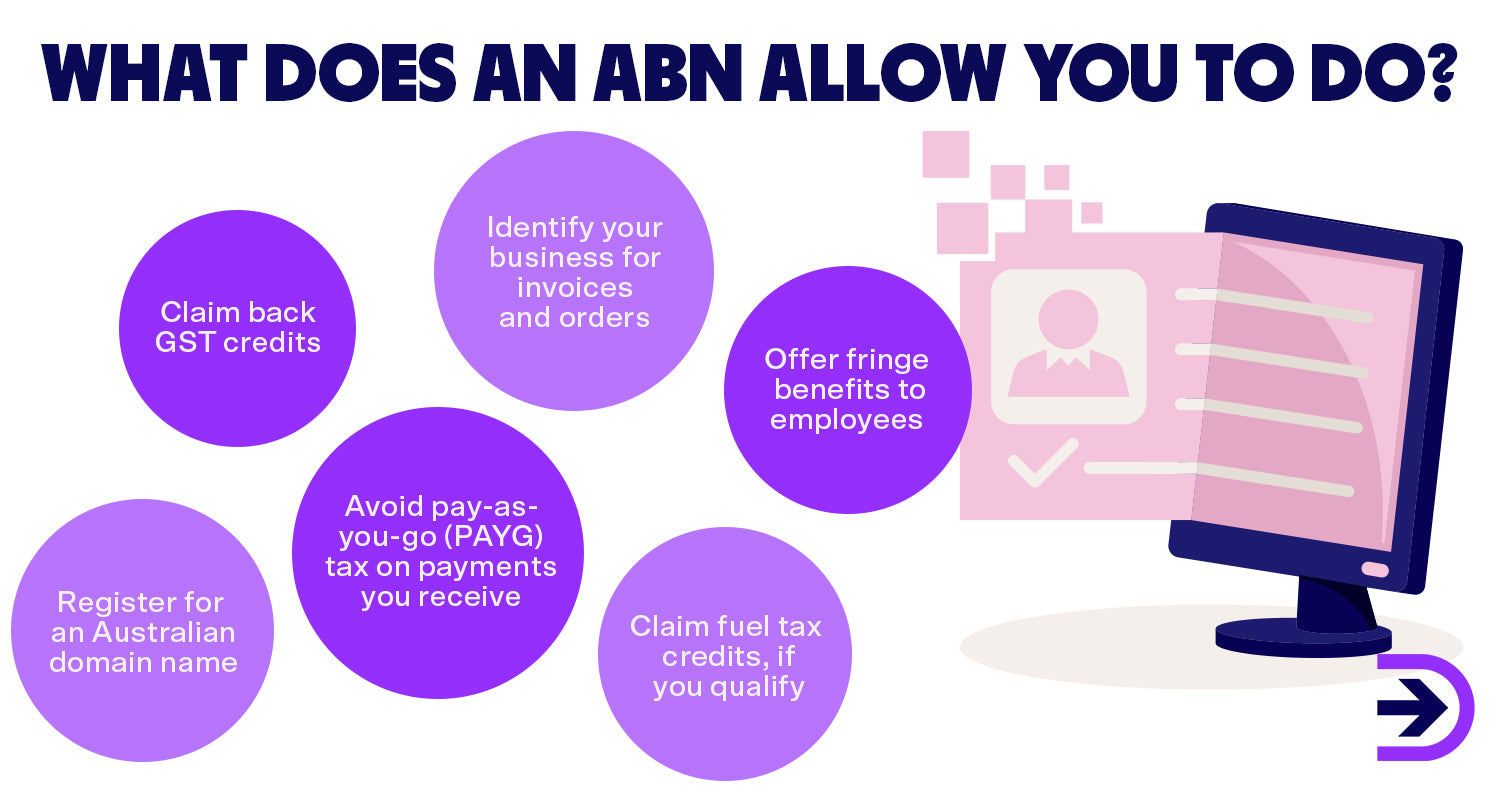

The first thing a new Australian business should register for is an ABN. An ABN is a unique 11-digit number used to identify businesses for tax purposes. It allows you to:

-

Identify your business for invoices and orders

-

Avoid pay-as-you-go (PAYG) tax on payments you receive

-

Claim back GST credits

-

Claim fuel tax credits, if you qualify

-

Offer fringe benefits to employees

-

Register for an Australian domain name

All businesses operating for profit must register for an ABN, even as a side hustle. Many dropshipping suppliers will not work with retailers without an ABN.

For more information about applying for an ABN, check out our blog “Do You Need an ABN for Dropshipping in Australia?”

Tax File Number (TFN)

A tax file number (TFN) is a personal reference number used in tax and superannuation systems. It is a unique 9-digit number that is yours for life. It is free to apply for a TFN. You will need a TFN to apply for an ABN and fulfil other tax obligations. If you are a sole trader with employees or a trust/partnership/company with employees, you will also need to apply for a Business TFN.

Name

Check the Business Names Register and Trade Mark Search to see if your chosen name is already being used or copyrighted. The fees for registering a business name are $42 for one year and $98 for nine years. The renewal fees are identical to registration. Transferring a business name is free, though the new owner has to pay the registration fee when registering under their details. Updating or cancelling a business name is free of charge.

Note: registering your business name does not automatically give businesses exclusive trading rights or ownership of the name. You can check your eligibility for trademark registration by visiting IP Australia.

Domain name

An ABN allows Australian businesses to register for a .com.au, .au or .net.au extension. The cost of your domain will depend on which platform you purchase from and the type of domain you want to register. You will also need to find a hosting provider, which will allow you to publish your site on the internet.

Many ecommerce platforms like Shopify, WordPress and Squarespace offer domain registration and hosting as part of their services, making it easy to register, build and host your site in one place.

Stay on Top of Your Tax Obligations

Goods and services tax (GST)

The Goods and Services Tax (GST) is a 10 per cent tax on most goods and services sold and consumed in Australia. If your business has a GST turnover of $75,000 or more, you must register for GST. This can affect product prices, as companies are required to collect GST from their customers and then pay taxes to the Australian Taxation Office (ATO). You may be able to claim back GST under certain circumstances.

GST also applies to imports such as services, digital products, and products worth $1000 or less. Overseas businesses with a GST turnover of $75,000 or more selling imports to Australia also should apply for an ABN. Exports, however, are GST-free if exported from Australia within 60 days of the supplier receiving payment or issuing an invoice for goods.

You can calculate your GST turnover and find more information by visiting the Australian Taxation Office website or business.gov.au.

Pay As You Go withholding (PAYG)

Business owners planning to hire employees in Australia have to register for PAYG withholding. Withholding occurs when you take a certain amount from a payment to an eligible party and give it to the ATO to pay income tax in advance.

A business in Australia must withhold tax from payments to:

-

Employees.

-

Contractors who you have entered into a voluntary agreement to withhold PAYG amounts.

-

Businesses that don’t quote their ABN number to you.

Businesses must register for PAYG as soon as they hire employees. It will require you to withhold amounts from employee wages and other payments, lodge activity statements, provide payment summaries to employees and payees before July 14 annually, and provide a withholding payment summary annual report to the ATO before August 14.

If you’re a sole trader in Australia, you may not need to register for PAYG instalments until you meet certain entry thresholds.

The best way to stay on top of your tax obligations is to hire an accredited accountant.

Other Employer Obligations

Although many dropshipping businesses will start with one employee and/or a single dropshipping partner, the business structure may change over time to include employees. You can visit the Australian Business Licence and Information Service (ABLIS) or the ATO website for more information.

Form a Dropshipping Agreement

A dropshipping agreement is a legal agreement between a retailer and a manufacturer/supplier. It outlines the responsibilities of each party relating to the business and clearly states the consequences and costs of not meeting them. This can include situations such as delayed shipping, damaged products, or missing products. It will also specify the agreed price of wholesale goods, sanctions for handling breach of contract, and acceptable levels of service (SLAs). Some ecommerce platforms and services, such as Amazon and Paypal, also require dropshippers to upload agreements before selling online. Your suppliers or ecommerce platform may provide you with a template for your dropshipping agreement, or you can find many templates online.

Have Airtight Terms and Conditions

Also known as Terms of Sale, Terms of Use and Terms of Service, this agreement helps protect you legally if something happens during the dropshipping process. It clearly represents the precise legal relationship between dropshippers and end customers and sets clear expectations for all parties. This includes the responsibilities of each party, what retailers are and are not liable for, intellectual property rights, whom customers can contact for dispute resolution, refunds and returns policies, and penalties for the violation of these terms. These should also include privacy statements that link to a comprehensive Privacy Policy, which covers the collection and use of customer data. Terms and Conditions should be easy to find and understand. Avoid as much legal jargon as possible.

Follow Consumer Law

Businesses selling goods in Australia (including overseas suppliers) must follow Australian Consumer Law set out in Schedule 2 of the Competition and Consumer Act 2010. All goods and services sold in Australia come with consumer guarantees automatically applied by the Australian Competition and Consumer Commission (ACCC). These cannot be removed regardless of a business’ Terms and Conditions. Under these laws, products and services sold must be fit for purpose, match the product description, match any samples or demo models, be of acceptable quality, and be free from defects. Businesses must also honour express warranties and provide repairs or spare parts within a reasonable time. Failure to comply with these laws may result in legal action.

Respect Intellectual Property & Copyright

Suppliers often supply images for online retailers to use in their product listings. Someone owns the copyright to these images. Usually, the supplier owns the copyright and provides retailers with the licensing to use them for the purpose of selling the product. If a supplier does not own the copyright and retailers use these images in their listings, they may be subject to copyright claims. Suppliers also need licensing agreements to sell online products featuring other’s intellectual property. This not only covers characters and motifs from pop culture but also stock photos, Google images, works of art posted on social media and other sources. Each of these sources is subject to platform-dependant terms and conditions. Visit IP Australia and view the Copyright Act 1968 for more information.

How Dropshipzone Compares

At Dropshipzone, we’re committed to helping entrepreneurs grow their online businesses to their fullest potential. We don’t cut corners when it comes to quality, which is just one of the reasons we’re the leading B2B2C ecommerce marketplace in Australia. Our dropshipping suppliers abide by strict criteria regarding the quality of products and customer service. Find Australian dropshipping suppliers and support local businesses and fast shipping products. We promote ethical business practices regarding social and environmental responsibility. We respect the privacy of our users as set out in our Privacy Policy. We offer the most competitive shipping fees on the market. Our blogs are free to access and offer data-driven solutions, marketing strategies and practical advice for dropshippers and other ecommerce businesses alike. We offer a tailored and dedicated support team ready to help at any time. Best of all, you can sign up for free within minutes and instantly gain access to our entire catalogue of locally sourced products, promotions, and more.

Join Dropshipzone today and see how you can launch a successful dropshipping business and attract Australian customers today.

Legal Dropshipping FAQs:

Can a dropshipper get sued?

While a successful dropshipping business is a low-risk venture, dropshippers can still be sued for many reasons, including copyright infringement, consumer rights violations, inaccurate representation or tax fraud. As long as you adhere to state, federal and international law, there is no additional risk of getting sued than in any other business.

Is dropshipping ethical?

Ethical concerns about dropshipping are focused on social and environmental issues. It is the responsibility of suppliers and retailers to ensure their products are ethically sourced. Thanks to growing concerns about health and human rights, it’s never been easier to find eco-friendly products that are reusable or recyclable, good for the environment, and prevent the exploitation of workers.

Do I need a business licence for dropshipping in Australia?

There is a difference between a business licence and a business registration in Australia. A license is something that gives a business permission to perform certain activities such as serving or selling alcohol, operating on public holidays, performing electrical work, or offering beauty and wellness services like hairdressing or fitness training. Dropshipping businesses do not need to apply for the same business licenses as a brick-and-mortar store, but they do need to apply for an ABN and have an individual or business TFN. For a comprehensive list of licenses and permits required, visit the Australian Business Licence and Information Service (ABLIS) website and use their license search feature.